The Great Crypto Rollercoaster: A Look at the Cryptocurrency Bubble Phenomenon

Cryptocurrencies(Cryptocurrency Bubble), digital assets designed for secure online transactions, have had a turbulent journey. While promising a decentralized and transparent financial revolution, they’ve been plagued by a series of cryptocurrency bubbles – periods of rapid price hikes followed by sharp declines. These cycles raise concerns about their long-term viability and legitimacy.

The Birth of Bitcoin and the First Cryptocurrency Bubble (2009-2011):

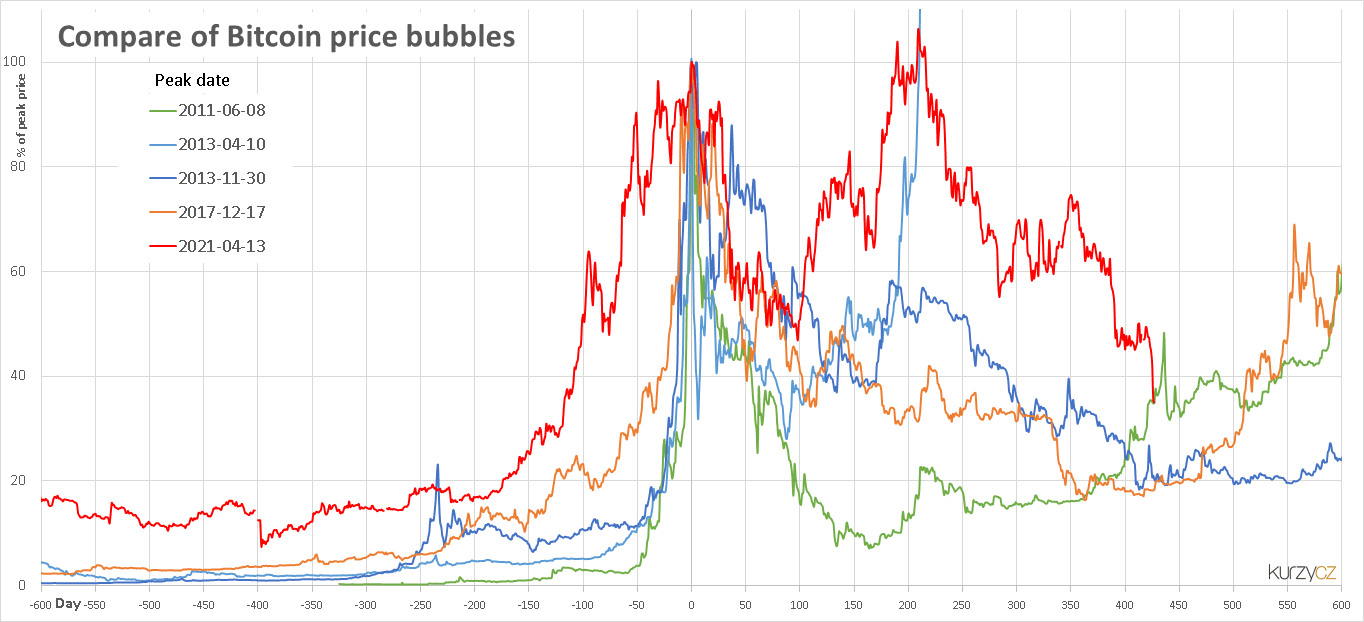

The story begins with Bitcoin, the first and most well-known cryptocurrency, launched in 2009. Its early years were defined by slow adoption and fluctuating prices. However, the first significant cryptocurrency bubble emerged in 2011. Fueled by positive media coverage and growing public interest, Bitcoin’s price skyrocketed from around $1 to nearly $32 in November 2011. This cryptocurrency bubble was attributed to several factors:

- Limited supply: Bitcoin’s capped supply of 21 million coins created scarcity, appealing to those seeking an inflation hedge.

- Technological novelty: The underlying blockchain technology offered a secure way to record transactions, attracting early adopters and techno-optimists.

- Media hype: Increased media attention fueled public interest and speculation, further inflating the cryptocurrency bubble.

However, the bubble burst in 2011, with prices plummeting to around $2 by year-end. This crash was triggered by concerns about Bitcoin’s legality, security breaches on exchanges, and the lack of widespread adoption.

The Rise of Altcoins and the Second Cryptocurrency Bubble (2017-2018):

Following the crash, the market entered a period of relative stability. But in 2017, a new era of exuberance began, fueled by the emergence of alternative cryptocurrencies (altcoins) and Initial Coin Offerings (ICOs) – a fundraising method unique to the crypto space. This new wave of innovation triggered another significant cryptocurrency bubble. Thousands of new altcoins were launched, each promising innovative solutions and functionalities, further attracting investors. ICOs offered individuals the opportunity to invest early in these projects, often with promises of high returns.

During this period, Bitcoin’s price reached a staggering peak of nearly $20,000 in December 2017. The broader market mirrored this trend, with many altcoins experiencing even more dramatic price increases. The factors contributing to this second cryptocurrency bubble were similar to the first, with additional elements fueling the fire:

- The rise of ICOs: Providing an easy entry point for investors, ICOs attracted both informed and uninformed individuals, many driven by the potential for quick profits within the cryptocurrency bubble.

- FOMO (Fear of Missing Out): With success stories emerging from the early days of Bitcoin, a cryptocurrency bubble mentality took hold, encouraging further investment without a thorough understanding of the underlying technology or project.

However, like its predecessor, this cryptocurrency bubble also burst in early 2018. The prices of Bitcoin and altcoins plummeted, with some losing over 90% of their value. The crash was attributed to multiple factors:

- Regulatory scrutiny: Governments around the world began scrutinizing ICOs and crypto markets, raising concerns about potential scams and illegal activities within the cryptocurrency bubble.

- Market manipulation: Accusations of market manipulation and fraudulent activities eroded investor confidence in the cryptocurrency bubble.

- Lack of underlying value: The realization that many cryptocurrencies lacked real-world use cases and their value was primarily driven by speculation led to a correction in the cryptocurrency bubble.

The Future of Cryptocurrencies: Beyond the Boom-and-Bust Cycle?

Since the 2018 crash, the cryptocurrency market has shown signs of recovery, albeit with significant fluctuations. While the question of whether another cryptocurrency bubble is on the horizon remains unanswered, the market continues to evolve, learning from the past.

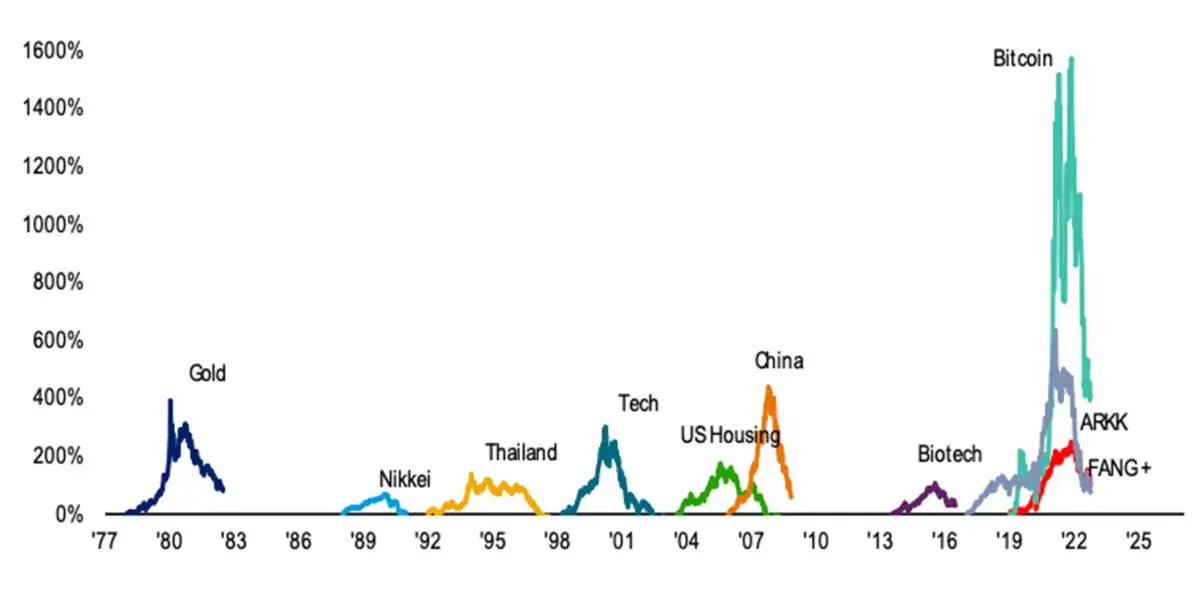

Some argue that these cryptocurrency bubbles are an inevitable part of any new technology’s early development stage, similar to the dot-com bubble of the late 1990s. They believe that with increased regulation, improved infrastructure, and the development of real-world applications, the cryptocurrency market can achieve long-term stability and growth.

However, others remain skeptical, highlighting the inherent volatility of cryptocurrencies and the potential for future cryptocurrency bubbles fueled by speculation and hype. They call for a cautious approach, emphasizing the need for robust regulation, investor education, and a focus on building genuine utility for cryptocurrencies to achieve sustainable growth.

The Human Factor: Psychology and the Cryptocurrency Rollercoaster

The narrative surrounding cryptocurrency bubbles often focuses on economic and technological factors. However, a crucial element often overlooked is the human element – the psychological forces that drive investor behavior and contribute to the boom-and-bust cycles.

Conclusion: Navigating the Cryptocurrency Rollercoaster – Beyond the Boom-and-Bust Cycles

The cryptocurrency journey has been a rollercoaster ride, marked by periods of explosive growth and dramatic collapses. These cryptocurrency bubbles have raised significant questions about their long-term viability and legitimacy within the financial landscape. While the future remains uncertain, valuable lessons can be gleaned from these past cycles, informing not just the future of cryptocurrencies but also the broader financial ecosystem.

The question of whether cryptocurrency bubbles represent an inevitable and recurring challenge remains unanswered. Some argue that these bubbles are a natural part of any nascent technology’s development stage, similar to the dot-com bubble of the late 1990s. They believe that with increased regulation, improved infrastructure, and continued development of real-world use cases, the cryptocurrency market can eventually achieve long-term stability and growth.

However, others remain skeptical, highlighting the inherent volatility of cryptocurrencies and the potential for future cryptocurrency bubbles fueled by speculation and hype. They call for a cautious approach, emphasizing the need for:

- Robust regulation: Establishing clear and well-defined regulations to combat fraud, protect investors, and ensure market integrity is crucial for fostering trust and promoting responsible innovation.

- Investor education: Educating the public about the risks and opportunities associated with cryptocurrencies is essential, empowering individuals to make informed investment decisions and avoid pitfalls associated with the cryptocurrency bubble mentality.

- Focus on utility: Encouraging and supporting the development of practical applications for cryptocurrencies beyond speculative investment is key to establishing long-term value and sustainable growth within the ecosystem.

The future of cryptocurrencies remains a work in progress. Whether they become a mainstream financial instrument or fade into obscurity hinges on their ability to navigate the challenges and harness the opportunities presented by the evolving financial landscape. By learning from the lessons of the past cryptocurrency bubbles, fostering innovation, and prioritizing responsible development, the industry can chart a course towards a more sustainable and prosperous future.