Demystifying Binance Copy Trading

Binance, a leading cryptocurrency exchange, offers a unique feature: copy trading. This functionality allows users to replicate the trading strategies of experienced traders, potentially earning profits without extensive market knowledge. This article delves into the intricacies of Binance copy trading, equipping you with the necessary information to make informed decisions.

Understanding Copy Trading

Copy trading automates mimicking the trades of chosen traders (signal providers) in your own Binance account. Whenever a signal provider opens or closes a position, your account mirrors the action proportionally based on your allocated capital.

Benefits of Copy Trading on Binance:

- Accessibility: Even beginners with limited trading experience can participate in the market by following established traders.

- Time Efficiency: Saves time spent on research and analysis, allowing you to focus on other aspects of your finances.

- Potential for Profits: By copying successful traders, you leverage their expertise and potentially generate returns.

- Diversification: Copy trading allows you to diversify your portfolio by following multiple traders with varying strategies.

Risks Associated with Copy Trading

- Past Performance Isn’t a Guarantee: A trader’s past success doesn’t guarantee future profitability. Market conditions can change rapidly.

- Signal Provider’s Risk Tolerance: Copying a high-risk trader can lead to significant losses if the market turns against them.

- Fees: Binance charges fees for both spot and futures trading, impacting your overall returns.

- Limited Control: You relinquish control over your trading decisions by following another trader.

Choosing the Right Trader to Copy on Binance

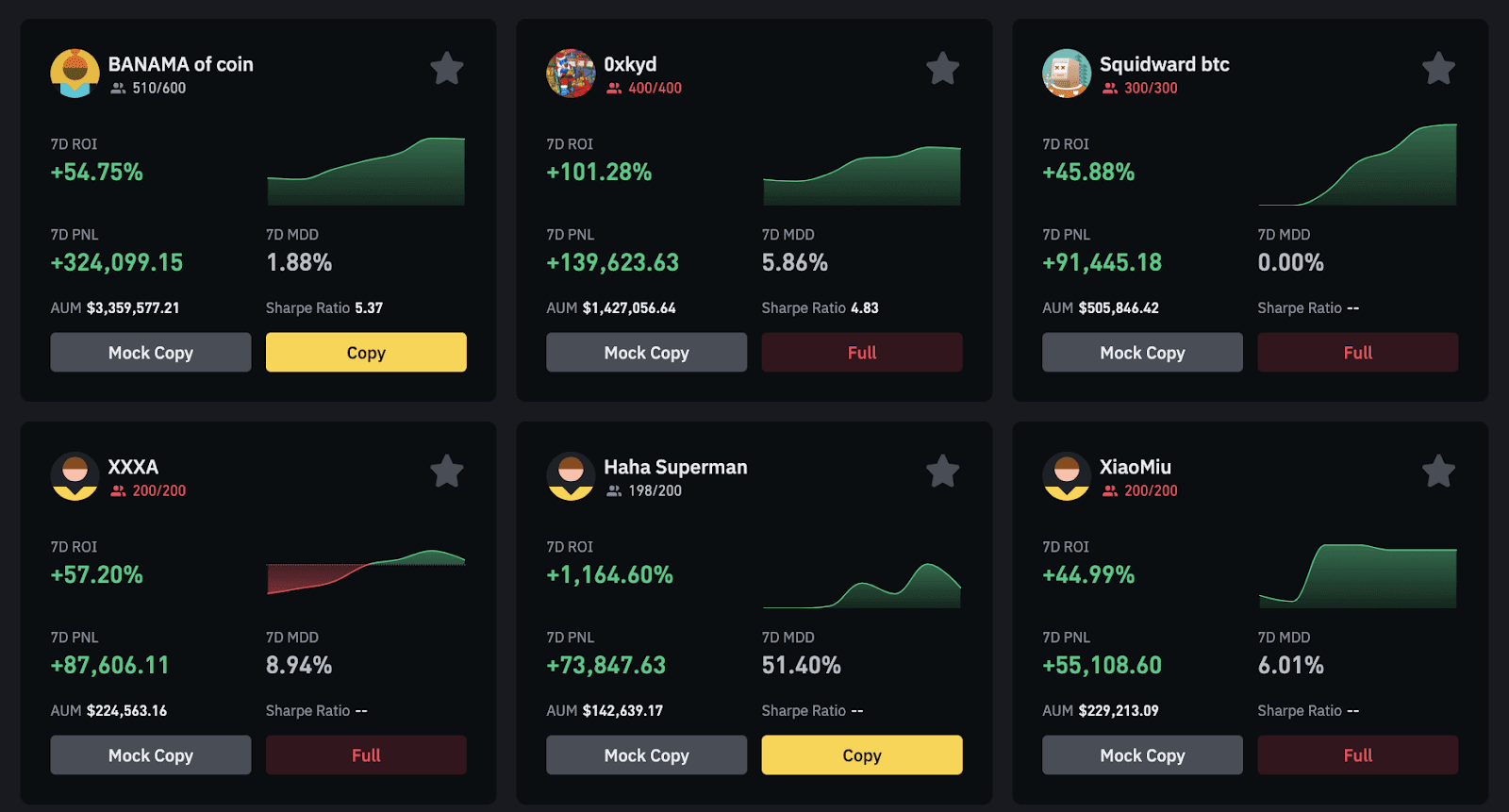

Selecting the appropriate trader is crucial for your copy trading success. Here are key factors to consider:

- Trading Performance: Analyze the trader’s win rate, profitability, and maximum drawdown (largest peak-to-trough loss).

- Trading Style: Align the trader’s strategy with your risk tolerance. Aggressive traders may not be suitable for risk-averse investors.

- Market Experience: Choose traders with a proven track record and experience in the specific market you’re interested in (e.g., spot or futures).

- Community Engagement: Active engagement with the community can provide insights into the trader’s thought process and risk management techniques.

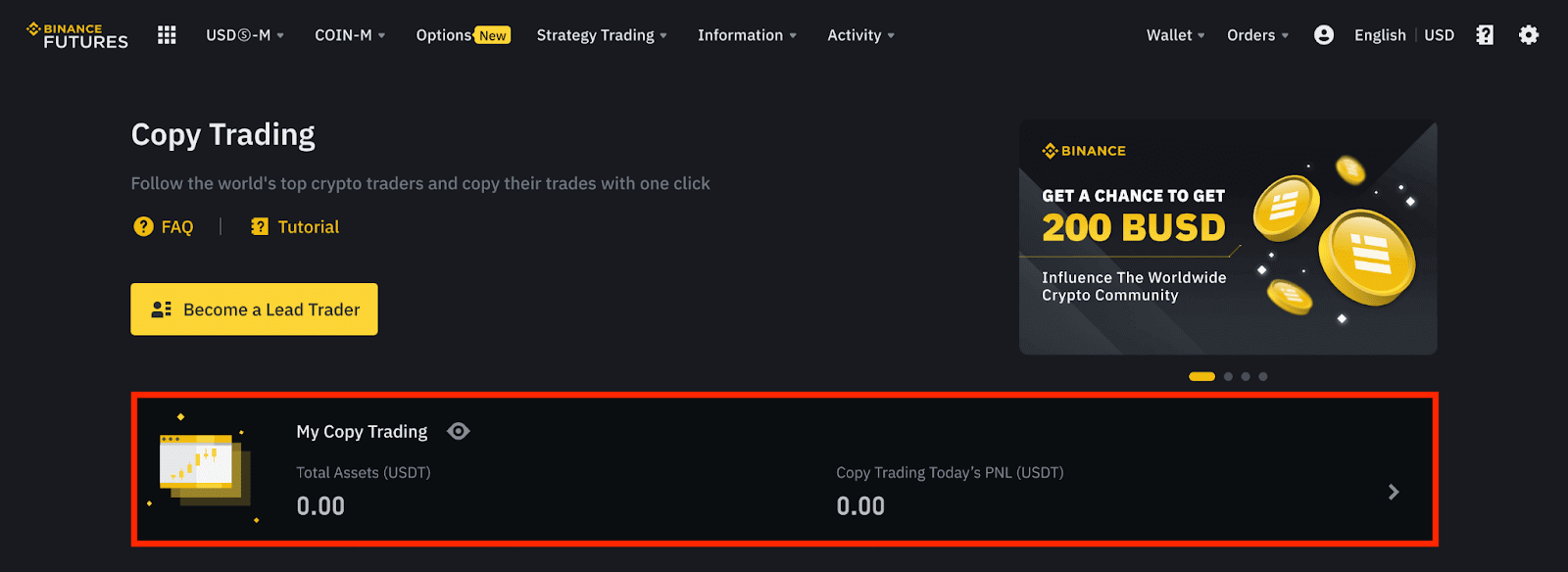

Binance Copy Trading Platform Overview

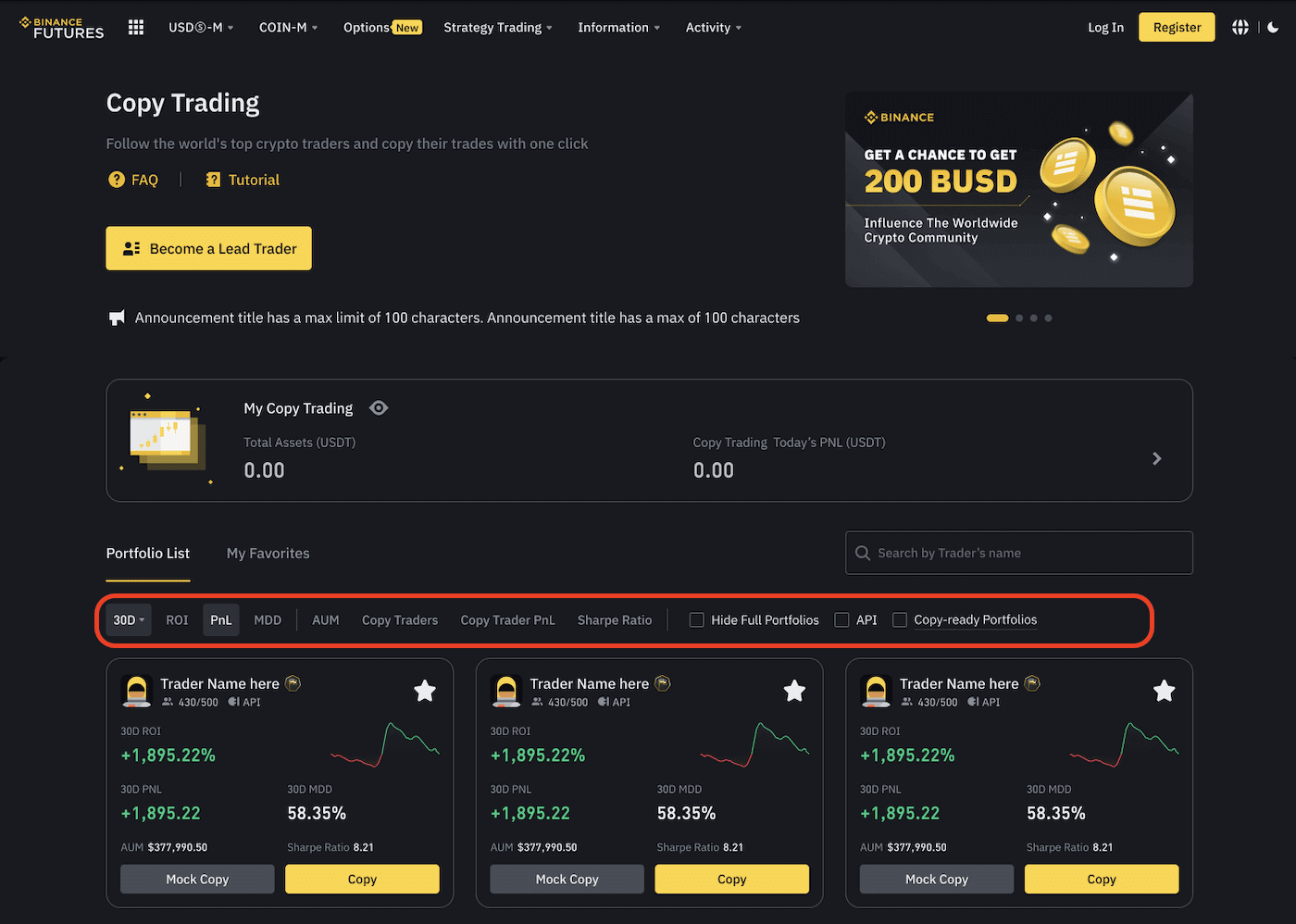

The Binance Copy Trading platform offers a user-friendly interface for selecting and managing copied traders. Here’s a breakdown of its key functionalities:

- Leaderboard: Browse a list of traders ranked by various metrics like total copied capital, win rate, and return on investment (ROI).

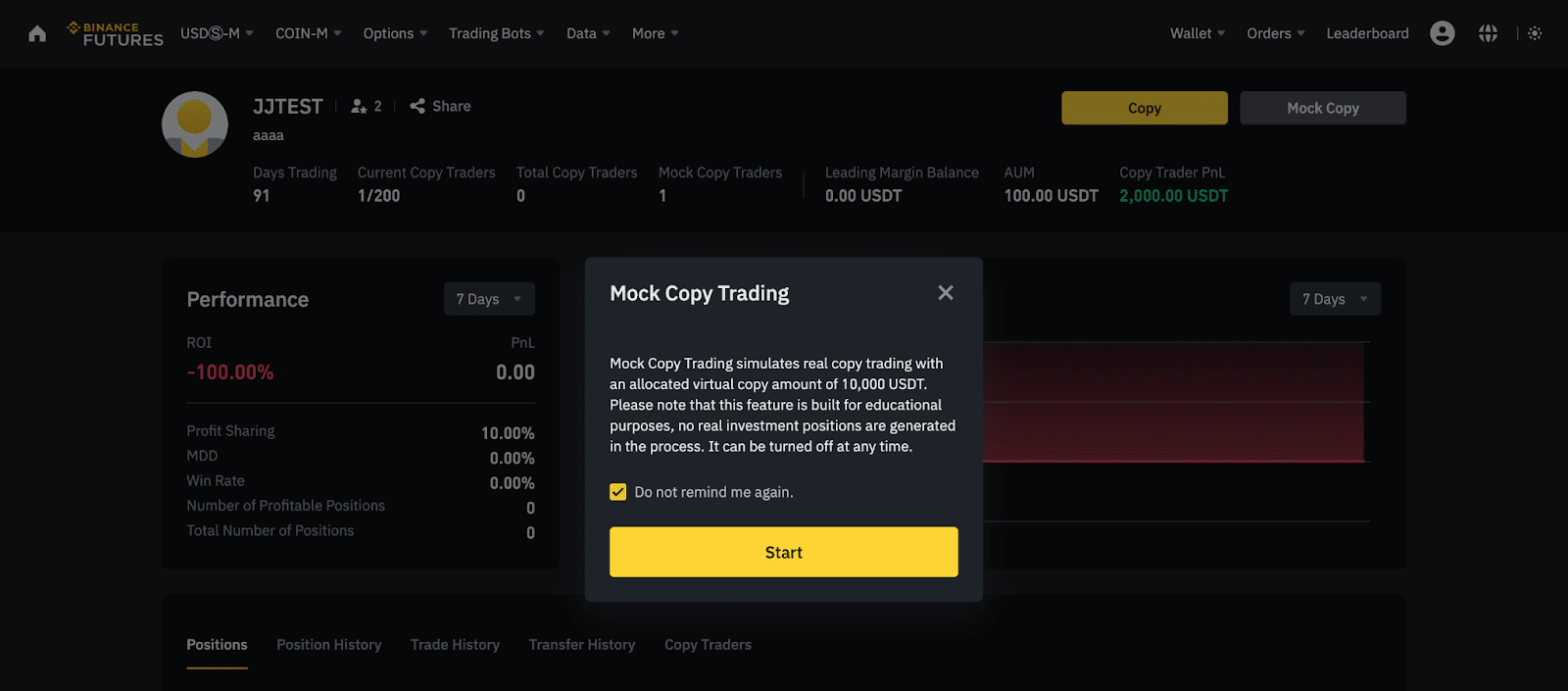

- Trader Profiles: In-depth profiles display detailed statistics, trading history, and risk management strategies.

- Allocation Settings: Define the amount of capital you want to allocate to each copied trader.

- Risk Management Tools: Set stop-loss and take-profit orders to manage risk and secure profits.

Getting Started with Binance Copy Trading:

- Create a Binance Account: If you haven’t already, register for a Binance account and complete the verification process.

- Fund Your Account: Deposit funds in your preferred cryptocurrency to use for copy trading.

- Navigate to Copy Trading: Locate the “Copy Trading” section on the Binance website or app.

- Select a Trader: Research and choose a trader that aligns with your risk tolerance and investment goals.

- Allocate Capital: Define the amount you want to allocate to copy trading with this specific trader.

- Set Risk Management: Utilize stop-loss and take-profit orders to manage potential losses and secure profits.

- Start Copying: Click the “Copy” button to begin replicating the chosen trader’s positions.

Advanced Copy Trading Strategies on Binance

While basic copy trading involves replicating all the signal provider’s actions proportionally, Binance offers advanced features for customization:

- Copying by Percentage: Allocate a specific percentage of your portfolio to each copied trader.

- Copying by Fixed Amount: Allocate a fixed amount of capital to each copied trader, regardless of their position size.

- Partial Following: Choose to copy only specific positions opened by the signal provider.

Beyond Binance: Third-Party Copy Trading Platforms

Several third-party platforms integrate with Binance, offering additional features for copy trading:

- Advanced Filtering: Filter traders based on more specific criteria like trading frequency and asset class.

- Social Trading Aspects: Interact with other copy traders, share strategies, and discuss market trends.

- Demo Accounts: Practice copy trading with virtual funds before committing real capital.

Tax Implications of Copy Trading

Cryptocurrency trading, including copy trading, can incur tax liabilities depending on your jurisdiction. Here’s a general overview, but consulting a tax professional for specific advice is crucial:

- Capital Gains Taxes: Profits from selling copied positions may be subject to capital gains taxes.

- Tax Reporting: You may need to report your copy trading activity and any resulting capital gains or losses on your tax return.

Copy Trading vs. Managed Crypto Funds

While copy trading offers a degree of automation, managed crypto funds provide a more hands-off approach. Here’s a comparison:

- Control: Copy trading allows more control over which traders you follow and the allocation of capital. Managed funds delegate investment decisions to the fund manager.

- Fees: Copy trading typically involves lower fees compared to managed funds, which may charge management fees and performance fees.

- Minimum Investment: Managed funds often have minimum investment requirements, whereas copy trading can be started with smaller amounts.

The Future of Copy Trading on Binance

The copy trading landscape on Binance is constantly evolving. Here are some potential future developments:

- Artificial Intelligence (AI)-Powered Signal Providers: AI algorithms could analyze market data and generate trading signals, potentially offering new insights.

- Regulation and Standardization: Regulatory frameworks for copy trading could emerge, promoting transparency and investor protection.

- Integration with Decentralized Finance (DeFi): Copy trading could potentially extend to DeFi protocols, allowing users to copy strategies involving decentralized assets.

Conclusion

Binance copy trading offers a compelling option for both new and experienced investors. By carefully selecting traders, managing risk effectively, and staying informed about market trends, you can leverage the expertise of successful traders and potentially achieve your investment goals. However, remember that copy trading doesn’t eliminate risk, and thorough research is paramount before allocating capital.

Additional Tips for Success in Binance Copy Trading

- Start Small: Begin with a small allocation of capital to test the waters and understand the mechanics of copy trading.

- Monitor Performance: Regularly monitor the performance of your copied traders and adjust your allocations as needed.

- Stay Disciplined: Don’t chase quick profits or panic-sell based on short-term market fluctuations. Maintain a long-term perspective.

- Keep Learning: Continuously educate yourself about the cryptocurrency market, trading strategies, and risk management techniques.

By following these guidelines and approaching copy trading with a cautious and informed perspective, you can increase your chances of success in this dynamic market.