The Great Bitcoin Halving: A Deep Dive into a Pivotal Event

The Bitcoin halving, a pre-programmed event etched into the very fabric of the cryptocurrency, is arguably one of the most anticipated occurrences in the digital asset landscape. Every roughly four years, the block reward for mining new Bitcoins is cut in half, significantly impacting the rate at which new coins enter circulation. This meticulously designed mechanism directly influences several key aspects of Bitcoin’s ecosystem, from its monetary policy to its long-term viability as a scarce digital asset.

This article delves into the intricacies of the Bitcoin halving, exploring its technical underpinnings, historical impact, and potential future implications. We’ll dissect the event itself, analyze its economic effects, and examine the perspectives of miners, investors, and the broader crypto community.

Unveiling the Halving Mechanism: A Look Under the Hood

Bitcoin’s magic lies in its decentralized nature. Unlike traditional fiat currencies controlled by central banks, Bitcoin operates on a distributed ledger technology known as blockchain. This publicly accessible record verifies and secures all transactions on the network. Miners, acting as the backbone of the system, compete to solve complex cryptographic puzzles to validate these transactions. As a reward for their computational power and contribution to network security, miners are compensated with newly minted Bitcoins.

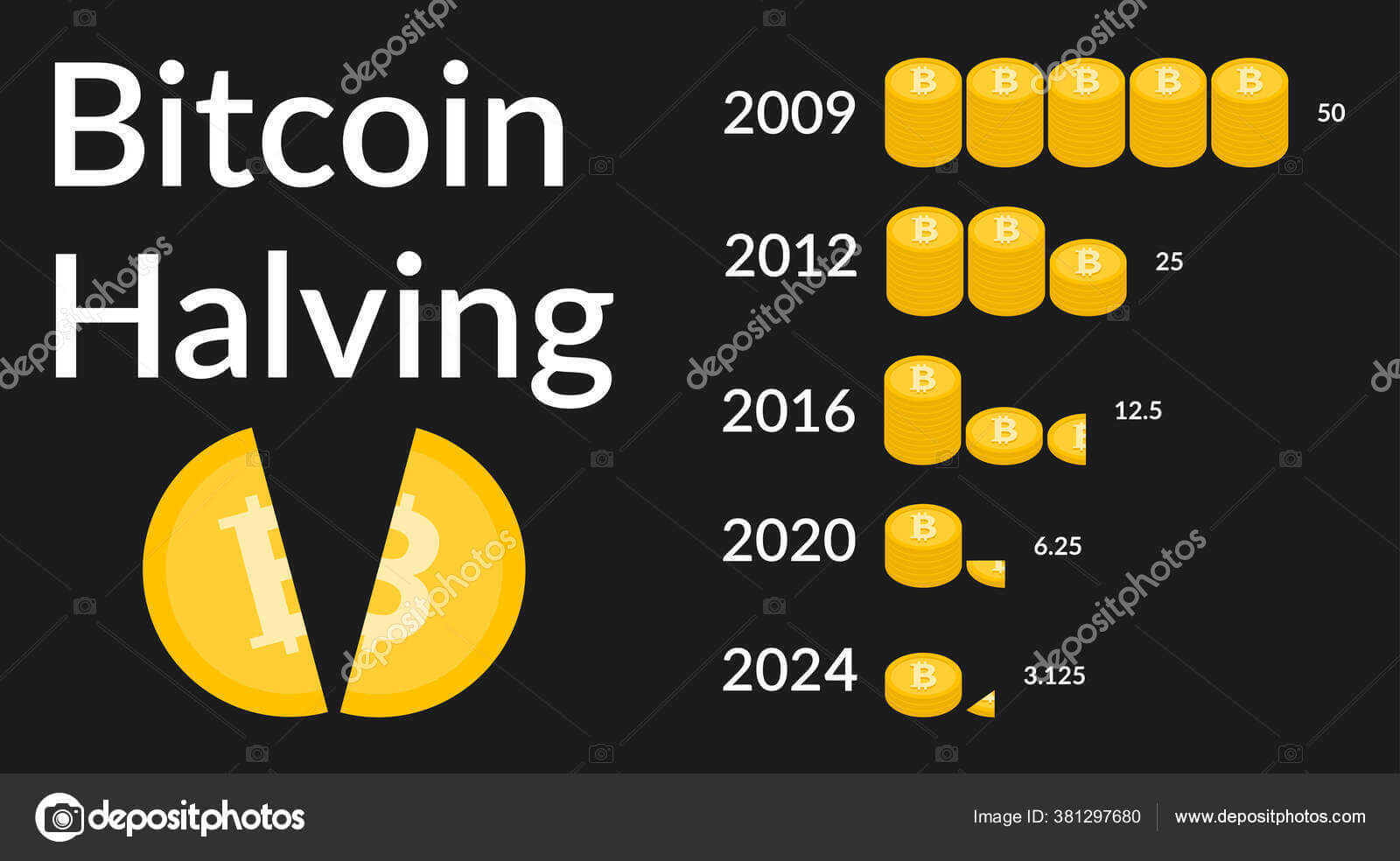

The halving event, embedded within Bitcoin’s core protocol, dictates a 50% reduction in this block reward. Initially set at 50 BTC, the reward witnessed its first halving in November 2012, dropping to 25 BTC. Subsequent halvings occurred in July 2016 (12.5 BTC) and May 2020 (6.25 BTC). The next halving is projected to take place in April 2024, bringing the reward down to 3.125 BTC. This programmed scarcity is a fundamental principle of Bitcoin, designed to mimic precious metals like gold, where the total supply is finite.

A Glimpse into History: How Halvings Have Shaped Bitcoin

The Bitcoin halving has a profound impact on the economic dynamics of the cryptocurrency. By restricting the inflow of new coins, halvings directly influence supply and demand. Here’s a closer look at how past halvings have played out:

-

The 2012 Halving: The first halving coincided with a nascent Bitcoin market. While the immediate price impact was muted, the event sparked discussions about Bitcoin’s long-term value proposition as a scarce asset.

-

The 2016 Halving: This halving witnessed a more significant price surge. Bitcoin price steadily climbed in the preceding year, culminating in a peak exceeding $20,000 in late 2017. While factors beyond the halving undoubtedly contributed to this rise, the event undeniably fueled market enthusiasm surrounding Bitcoin’s limited supply.

Bitcoin Halving 2024. Block reward reduced in two times. Deflationary currency. Illustration on dark background -

The 2020 Halving: Occurring amidst the global pandemic, the 2020 halving presented unique circumstances. Despite the economic turmoil, Bitcoin price embarked on a remarkable bull run, surpassing its 2017 highs and reaching new all-time records above $60,000 in 2021. However, disentangling the halving’s specific influence from broader market trends and institutional adoption remains a topic of debate.

It’s important to note that correlation doesn’t necessarily imply causation. While historical trends suggest a price upswing following halvings, other factors like market sentiment, regulatory developments, and technological advancements also play a crucial role.

The Economic Butterfly Effect: Potential Ramifications of the 2024 Halving

The upcoming 2024 halving is a highly anticipated event, with experts offering diverse predictions about its impact. Here are some potential consequences to consider:

-

Supply Shock: With the block reward diminishing, the total number of new Bitcoins entering circulation will further decrease. This potential supply shock could trigger a price appreciation if demand remains constant or increases.

-

Miner Recompense: The reduced block reward might affect the profitability of mining, particularly for miners with less efficient hardware. This could lead to industry consolidation, favoring larger mining pools with economies of scale.

-

Network Security: The economic incentive for mining plays a vital role in securing the Bitcoin network. If mining becomes less profitable, some miners might migrate to other cryptocurrencies. However, the potential rise in Bitcoin price after the halving could counteract this, maintaining sufficient economic incentive for network security.

-

Investor Psychology: The halving narrative often generates significant hype and speculation within the crypto community. This can lead to increased buying pressure and price volatility in the short term.

It’s crucial to remember that the cryptocurrency market is inherently volatile and influenced by various complex factors. Predicting the precise outcome of the 2024 halving remains a challenging endeavor.

Building upon the foundation laid in the first part of this article, let’s delve deeper into some additional aspects of the Bitcoin halving and explore its multifaceted nature.

Beyond Price: Broader Implications of the Halving

While price movements often dominate discussions surrounding the halving, the event carries broader implications for the Bitcoin ecosystem:

-

Sustainability of Mining: The halving compels miners to become more efficient. As the block reward shrinks, miners need to optimize their operations by adopting energy-efficient hardware and seeking alternative energy sources. This can contribute to a more sustainable Bitcoin mining landscape.

-

Bitcoin Halving Decentralization and Network Security: A core tenet of Bitcoin is decentralization. The halving, by potentially reducing the number of profitable miners, could raise concerns about centralization. However, the potential rise in Bitcoin price after the halving could incentivize new miners to enter the network, maintaining a healthy level of decentralization. Additionally, the increased value of securing transactions could further incentivize miners, even with a lower block reward.

-

The Store of Value Argument: The halving reinforces Bitcoin’s narrative as a digital store of value. Similar to precious metals, Bitcoin’s finite supply, programmed scarcity, and resistance to inflation could make it an attractive asset for investors seeking long-term value preservation.

-

The Future of Bitcoin Development: The halving serves as a critical juncture to evaluate Bitcoin’s development roadmap. With mining rewards diminishing over time, alternative funding mechanisms might be necessary to sustain the network’s growth and development. This could lead to discussions about transaction fees, alternative incentive structures for miners, or the potential evolution of Bitcoin’s economic model.

The Human Factor: Perspectives on the Halving

The Bitcoin halving is not merely a technical event; it also ignites discussions and debates within the human element of the cryptocurrency ecosystem. Here’s a look at some key stakeholders’ perspectives:

-

Miners: As the backbone of the network, miners are directly impacted by the halving. While the reduced block reward presents profitability challenges, the potential increase in Bitcoin price post-halving offers a balancing act. Additionally, miners play a crucial role in advocating for efficient mining practices and promoting the sustainability of the network.

-

Investors: The halving presents a unique opportunity for investors. Understanding the potential supply shock and its historical correlation with price increases can inform investment strategies. However, investors must exercise caution and conduct thorough research, recognizing the inherent volatility of the cryptocurrency market.

-

Developers: Developers play a critical role in the ongoing evolution of Bitcoin. The halving can spur discussions about alternative funding mechanisms and the long-term sustainability of the network’s development. Additionally, developers can explore ways to optimize mining efficiency and network security.

-

Regulators: Regulatory bodies are increasingly scrutinizing the cryptocurrency landscape. The halving might raise questions about the environmental impact of Bitcoin mining and the potential for market manipulation. Open communication and collaboration between regulators and the Bitcoin community are crucial for navigating these complexities.

Conclusion: The Halving – A Catalyst for Change

The Bitcoin halving is more than just a halving of block rewards; it’s a catalyst for change within the Bitcoin ecosystem. It compels adaptation, innovation, and a reevaluation of the network’s long-term sustainability. As we approach the 2024 halving, the crypto community is abuzz with anticipation. While the precise outcome remains uncertain, one thing is clear: the halving will undoubtedly shape the future trajectory of Bitcoin and the broader cryptocurrency landscape.

This deep dive has explored the technical underpinnings of the halving, its historical impact, and its potential future implications. By understanding these multifaceted aspects, stakeholders within the ecosystem can navigate the upcoming event with greater knowledge and informed decision-making. The Bitcoin halving serves as a reminder of the transformative potential of this nascent technology and the ongoing journey towards a decentralized future.