Unveiling the Crypto Rollercoaster: Exploring Top Gainers of Crypto and Strategies

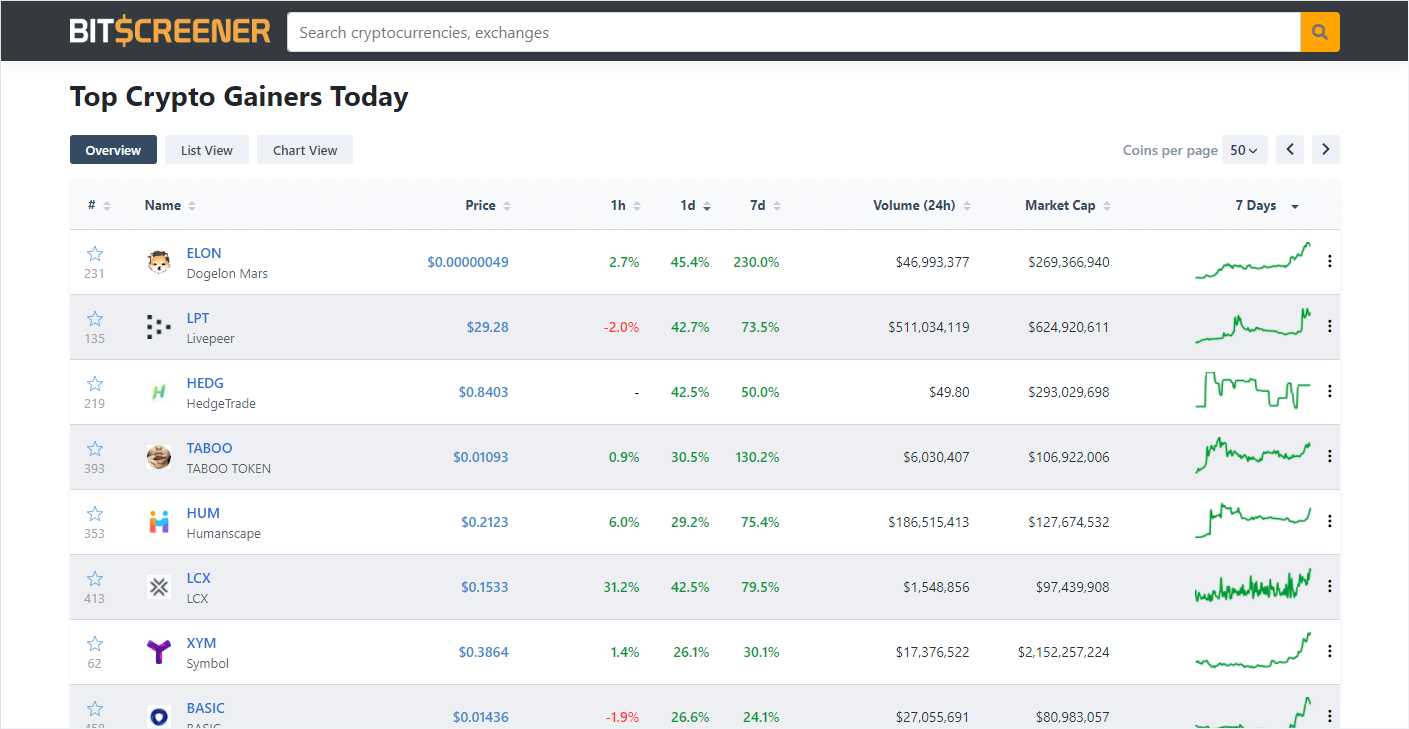

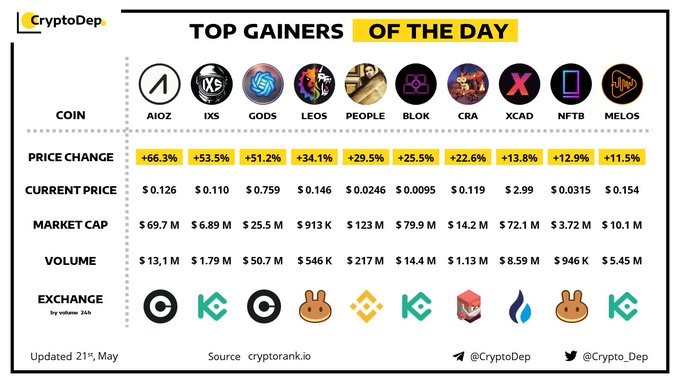

The cryptocurrency market, with its inherent volatility, presents a unique landscape for investors. While established players like Bitcoin and Ethereum dominate headlines, the true allure for some lies in the potential for explosive growth offered by lesser-known altcoins (alternative coins). Identifying these Top Gainers of Crypto can be a thrilling but risky endeavor, requiring a keen understanding of market dynamics and a healthy dose of caution.

This article delves into the world of top crypto gainers, exploring factors influencing their rise, strategies for navigating this volatile space, and potential risks to consider.

The Allure of Top Gainers of Crypto: Why Do Some Coins Skyrocket?

The cryptocurrency market thrives on speculation and innovation. Unlike traditional assets backed by tangible resources, cryptocurrencies derive their value from factors like:

- Underlying Technology: Some projects propose novel blockchain technologies or innovative applications that have the potential to disrupt existing industries. Investor excitement surrounding this potential can fuel rapid price increases.

- Market Sentiment: Positive news, community hype, and influencer endorsements can significantly impact investor sentiment, driving a surge in demand for a specific coin.

- Low Market Capitalization: Smaller cryptocurrencies, with a lower total value of all outstanding coins (market cap), are more susceptible to significant price fluctuations. A relatively small influx of investment can trigger a substantial percentage increase in their value.

Identifying which factors will propel a particular coin to become a top gainer requires careful research and a nuanced understanding of the cryptocurrency ecosystem.

Finding the Next Big Thing: Strategies for Identifying Top Gainers of Crypto

While predicting the future is impossible, there are strategies to help you navigate the world of top crypto gainers:

- Fundamental Analysis: Research the project behind the coin. Evaluate the underlying technology, its potential applications, and the development team’s expertise. Look for solutions that address real-world problems and have a clear roadmap for growth.

- Technical Analysis: Technical analysis involves studying price charts and market indicators to identify trends and potentially predict future price movements. While not foolproof, this can help you identify coins with strong momentum that might be poised for further gains.

- Community Engagement: Actively participate in online forums and communities dedicated to specific crypto projects. Gauge community sentiment, identify potential red flags, and gain insights into the project’s overall health and development progress.

- Diversification: It’s crucial not to “go all-in” on any single top gainer. Diversify your crypto portfolio across established coins like Bitcoin and Ethereum alongside a few promising altcoins to spread your risk and mitigate potential losses.

Remember, thorough research and a balanced approach are key to navigating the volatile world of top crypto gainers.

Responsible investment practices can help you navigate the crypto market and potentially profit from Top Gainers of Crypto while minimizing the inherent risks.

A Balancing Act: Risks Associated with Top Gainers of Crypto

The potential for massive returns in the crypto market comes hand-in-hand with significant risks. Here are some key considerations:

- Market Volatility: Cryptocurrencies are notoriously volatile, susceptible to sudden and dramatic price swings. Even a promising top gainer can experience a sharp decline, resulting in significant losses for investors.

- Pump-and-Dump Schemes: Beware of manipulative tactics. Some projects might be artificially inflated by coordinated efforts to drive up the price before a swift sell-off, leaving unsuspecting investors holding the bag.

- Rug Pulls: In a “rug pull,” developers behind a project might abandon it after raising funds through an initial coin offering (ICO), leaving investors with a worthless coin. Always conduct thorough research on the team and project before investing.

- Regulation: The regulatory landscape surrounding cryptocurrency is constantly evolving. Regulatory changes can significantly impact the value of certain coins, making it crucial to stay updated on developments in this space.

Understanding these risks is vital before venturing into the realm of top crypto gainers.

Beyond the Hype: Responsible Investment Strategies

Investing in top crypto gainers requires a responsible approach that prioritizes risk management:

- Invest What You Can Afford to Lose: Only allocate a portion of your investment portfolio to cryptocurrencies, an amount you’re comfortable losing entirely. Treat it as a high-risk, high-reward investment.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money into a specific coin at regular intervals, regardless of the price. This strategy helps average out the purchase price over time and mitigate the impact of market volatility.

- Set Stop-Loss Orders: A stop-loss order automatically sells your investment if the price falls below a predefined level. This helps limit potential losses if the market takes an unexpected downturn.

- Stay Informed: Keep yourself updated on the latest developments in the cryptocurrency market. Stay vigilant of potential scams and adjust your investment strategies accordingly.

Looking Ahead: The Future of Top Gainers of Crypto and the Crypto Landscape

The future of top crypto gainers and the broader cryptocurrency landscape remains uncertain but holds immense potential. Here are some trends to watch:

- Institutional Adoption: As more traditional financial institutions embrace cryptocurrencies, their legitimacy and stability could increase, potentially leading to a more mature market with less volatility.

- Regulation and Clarity: Clearer regulations from governments worldwide can provide a more stable environment for innovation within the cryptocurrency space. This could attract further investment and fuel the growth of promising projects.

- Technological Advancements: The underlying blockchain technology continues to evolve. Advancements in scalability, security, and interoperability can pave the way for the development of new and impactful cryptocurrency applications.

- Focus on Utility: The future might see a shift towards cryptocurrencies with real-world utility and established use cases. Coins that solve specific problems or offer unique functionalities could become the next generation of Top Gainers of Crypto.

By staying informed about these trends and employing responsible investment strategies, you can be better positioned to potentially benefit from the ever-evolving world of top crypto gainers and the cryptocurrency market as a whole.

Conclusion

The allure of top crypto gainers is undeniable. However, navigating this volatile space requires a healthy balance between calculated risk-taking and responsible investment practices. By thoroughly researching projects, understanding the underlying risks, and employing a diversified approach, you can potentially reap the rewards offered by this exciting, albeit unpredictable, market. Remember, the cryptocurrency landscape is constantly evolving, and staying informed is paramount for making sound investment decisions.